Business Insurance in and around Longmont

Get your Longmont business covered, right here!

Insure your business, intentionally

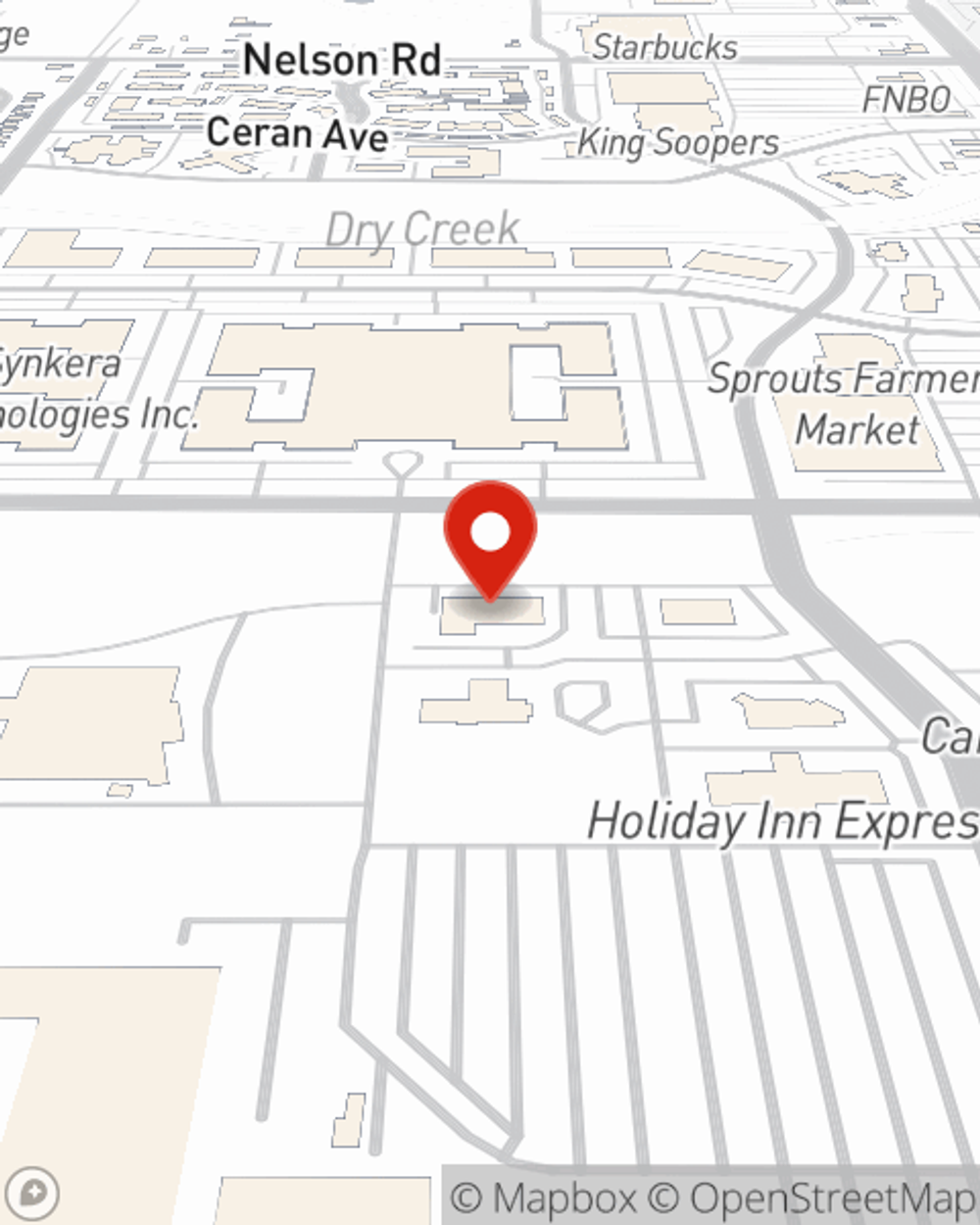

- Longmont

- Louisville

- Boulder

- Niwot

- Mead

- Berthoud

- Frederick

- Firestone

- Lyons

- Lafayette

- Erie

- Gunbarrel

Help Protect Your Business With State Farm.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes accidents like a customer stumbling and falling can happen on your business's property.

Get your Longmont business covered, right here!

Insure your business, intentionally

Small Business Insurance You Can Count On

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like extra liability or a surety or fidelity bond, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Jennifer Paris can also help you file your claim.

Take the next step of preparation and reach out to State Farm agent Jennifer Paris's team. They're happy to help you discover the options that may be right for you and your small business!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jennifer Paris

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.